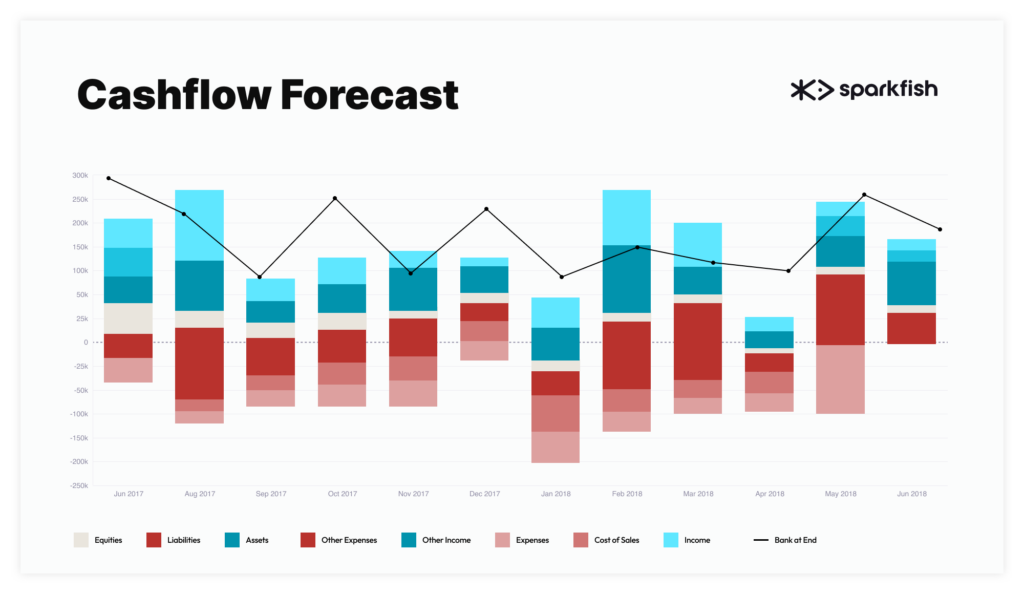

Cashflow Modeling

Know where your revenue, expenses, investments, loans, and other financial activities stand at any given moment.

Know Where Your Revenue is Coming From and Going to

Cash flow modeling is a financial technique used to analyze and predict the inflows and outflows of cash within a business over a specified period.

It involves creating a detailed representation of expected cash movements, considering factors such as revenue, expenses, investments, loans, and other financial activities.

Better Insights, Better Decisions

Cash flow modeling’s primary purpose is to provide insights ino the timing and amount of cash flows, helping organizations make informed decisions about their finances.

By projeting future cash flows, stakeholders can assess the financial viability and potential risks associated with a business venture, investment, or new product.

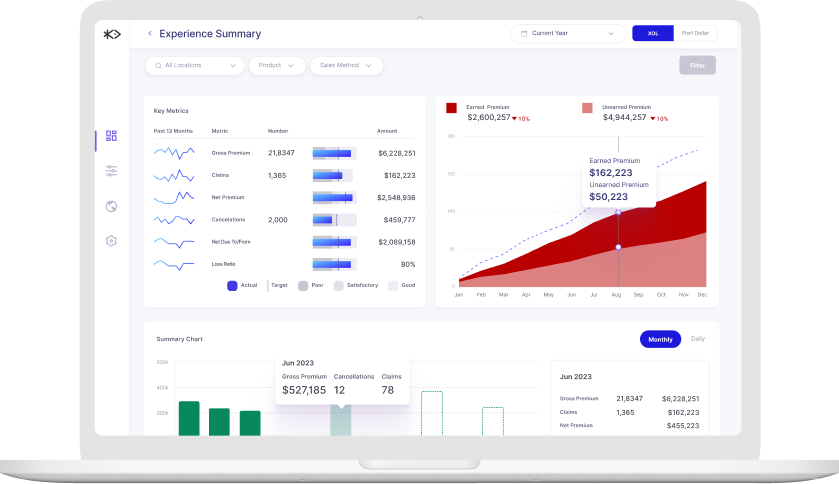

Assess Your Business's Solvency In Real Time

With a well structured cash flow model, businesses are able to assess the liquidity and solvency of their operations, evaluate the need for external funding, and make informed decision.