Private Equity

Custom Software

Custom software development, data management and data analytics for Private Equity Firms.

Simplifying Private Equity Software Development

Sparkfish provides the expertise and human capital necessary to tackle complex software and data management challenges. Our goal is to find the best path to solving complex problems.

How We Can Help

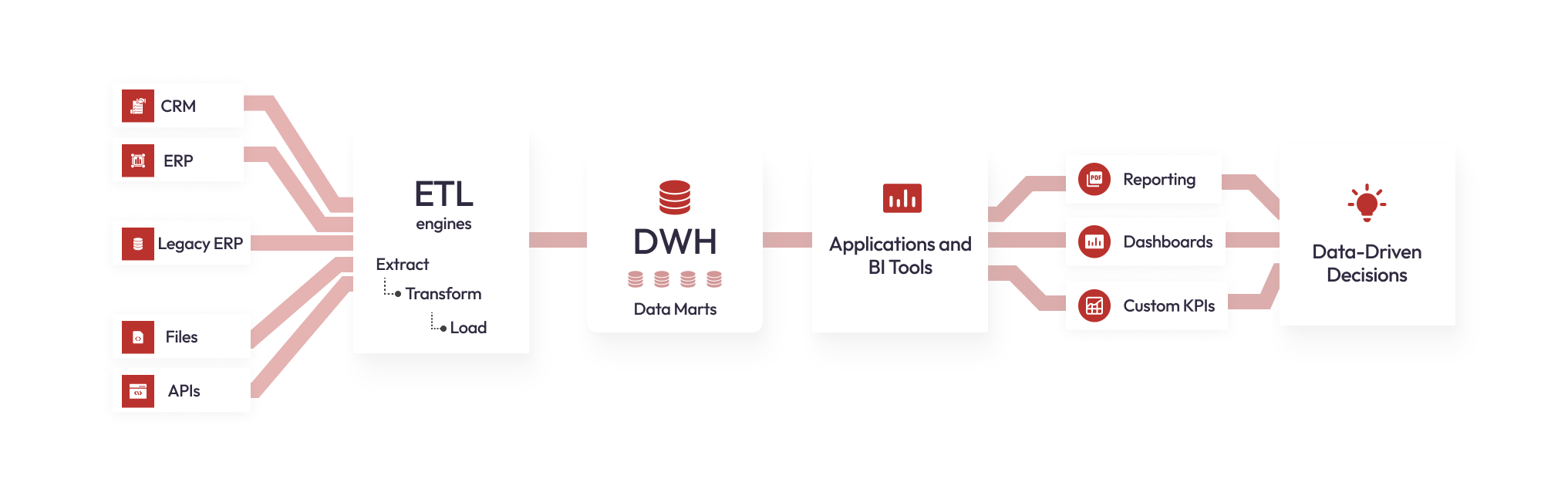

We worked with a client’s portfolio company to consolidate data from multiple ERP systems of varying ages to create a streamlined reporting system, along with KPIs based on certain metrics.

With the new ease of reporting along with new KPIs to measure business performance against, the portfolio company was able gain valuable insights into areas that needed improvement, in turn creating increased value for our client.

Solving Complex Software & Data Challenges

What Others Have To Say

FAQ

Private Equity Services

Custom KPI (Key Performance Indicator) and analytics dashboards are tools used by businesses to track and measure their performance against specific goals or metrics. These dashboards are customized to display key performance metrics that are important to the business, such as sales revenue, website traffic, customer retention rates, or employee productivity.

Analytics dashboards provide a visual representation of these metrics and allow businesses to quickly and easily monitor their performance in real-time. This helps them to identify areas where they are excelling and areas where they need to improve. By tracking and analyzing this data, businesses can make data-driven decisions that can help them optimize their operations and improve their bottom line.

Custom KPIs are metrics that are unique to a specific business or industry and are not typically tracked by standard KPIs. For example, a business in the healthcare industry may track patient satisfaction rates as a custom KPI.

Custom FP&A (Financial Planning and Analysis) Software Solutions refer to software applications developed to meet the specific needs of a business or organization for financial planning and analysis.

FP&A software is used to manage financial data, analyze and forecast financial performance, and create reports that help organizations make informed decisions. Custom FP&A software solutions can be developed to fit the unique requirements of an organization, which may include factors such as the size of the organization, the industry it operates in, and its specific financial management needs.

Custom FP&A software solutions can include features such as budgeting and forecasting, financial modeling, cash flow management, variance analysis, scenario planning, and financial reporting. These solutions can be integrated with other financial systems and data sources to provide a comprehensive view of an organization’s financial performance.

Data management refers to the process of collecting, storing, organizing, and maintaining data, while data analytics involves the extraction of useful insights and knowledge from that data. Together, data management and analytics enable organizations to make informed decisions, solve complex problems, and optimize their operations.

Data management involves a range of activities such as data entry, quality control, data warehousing, and data governance. The goal is to ensure that data is accurate, complete, secure, and accessible. This includes developing and maintaining databases, data warehouses, and data lakes that can store large amounts of data in a structured and efficient manner.

Data analytics, on the other hand, involves using various techniques to analyze data and extract insights that can be used to improve business processes, products, and services. This includes statistical analysis, machine learning, data mining, and data visualization. By analyzing data, organizations can identify patterns, trends, and correlations that can help them make better decisions and gain a competitive advantage.

Overall, data management and analytics are critical components of any organization’s data strategy. By effectively managing and analyzing data, organizations can unlock valuable insights, improve operational efficiency, and drive innovation.

Custom ERPs (Enterprise Resource Planning) and integrations refer to tailored software solutions that are designed and developed to meet specific business needs and requirements. Custom ERPs are typically built from the ground up to address a company’s unique processes, workflows, and data management needs, while integrations allow different software systems to communicate and share data seamlessly.

Custom ERPs can be developed for a range of business functions, such as accounting, supply chain management, customer relationship management (CRM), human resources, and more. These solutions can include features like customized dashboards, automated workflows, specialized reporting tools, and advanced analytics capabilities. Custom ERPs are often more efficient and effective than off-the-shelf ERP systems, as they are specifically tailored to the company’s unique business needs.

Integrations, on the other hand, refer to the process of connecting different software systems to enable data sharing and communication. For example, a company might integrate their CRM system with their accounting software, so that sales data can be automatically transferred and recorded in the company’s financial records. Integrations can be complex and require specialized expertise to ensure that different systems are properly connected, and that data is being shared accurately and securely.

Technical due diligence is an assessment process that evaluates the technical aspects of a company, product, or service. It is usually carried out when an investor is considering investing in a company, acquiring a company, or partnering with a company. The purpose of technical due diligence is to identify any technical risks or issues that could impact the success of the investment, acquisition, or partnership.

The technical due diligence process typically involves a thorough review of the company’s technology infrastructure, software, hardware, and systems, as well as an assessment of the technical team’s capabilities and expertise. The assessment is usually carried out by a team of technical experts who have the necessary knowledge and experience to evaluate the technical aspects of the company.

The results of the technical due diligence process can be used to identify potential technical risks and issues, as well as opportunities for improvement and optimization. This information can be used to inform investment decisions, negotiate acquisition terms, and develop a plan for partnering with the company.

Business Process Improvement (BPI) refers to the practice of analyzing and redesigning workflows and processes within an organization to improve efficiency, reduce costs, and enhance quality. BPI involves identifying areas of inefficiency and waste, and then developing and implementing strategies to improve those processes. The aim is to streamline operations, eliminate redundancies, and create a more agile and productive organization.

Automation, on the other hand, involves using technology to perform tasks that were previously done manually. Automation can be applied to various aspects of business processes, such as data entry, report generation, and customer service. The goal of automation is to increase efficiency and accuracy, reduce errors, and free up employees to focus on more value-added tasks.

In many cases, BPI and automation go hand in hand. For example, identifying inefficient processes can lead to opportunities for automation, and implementing automation can often improve efficiency and streamline workflows. Together, BPI and automation can help organizations become more competitive, improve customer satisfaction, and reduce costs.